Current Tax Assessment & Estimated Bond Impact

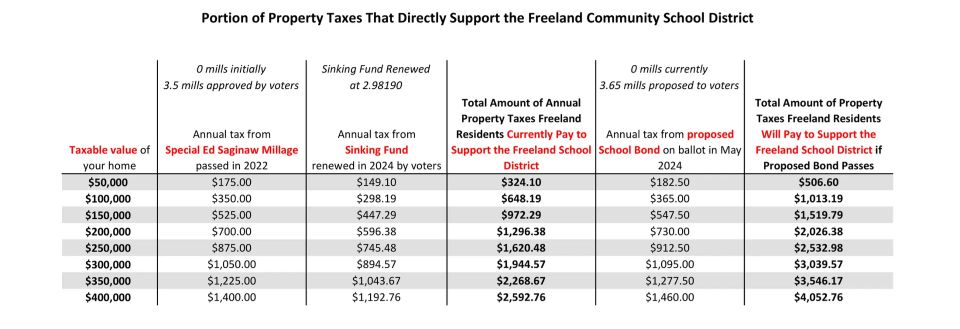

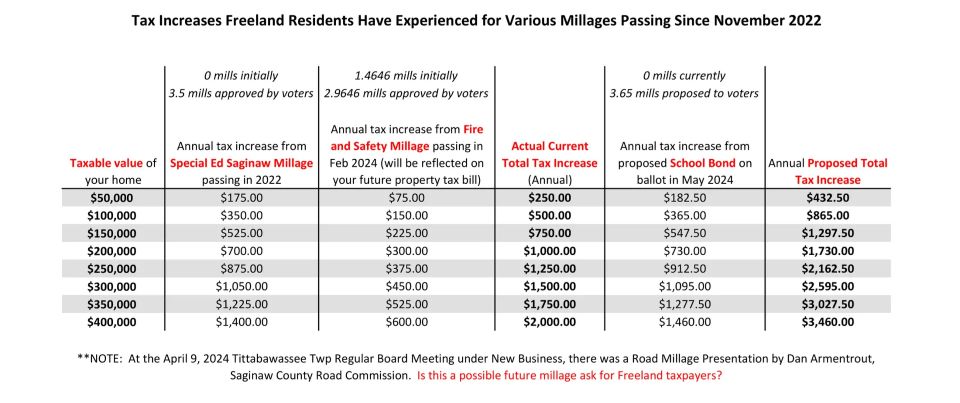

We have provided some charts with realistic numbers of how your current taxable value is and could be for the future. I think it is wrong when people say we are not investing in our community when we want to vote no on this bond. We do invest in the community; we already pay for the sinking fund and we already pay for the ISD millage. Yes, they are not the bond but it is debt to the taxpayer. The board or our superintendent and some people in the community say we are debt-free, how can they say that? We are not debt-free.

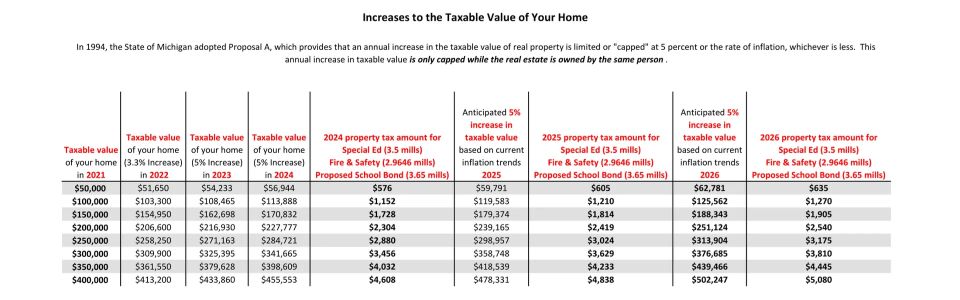

If we took out the sinking fund and the ISD millage and replaced it with our bond, we actually as homeowners would save money, but yet our community wants us to pay even more with this new bond. Somewhere along the line sacrifices have to be made, and it shouldn’t always be the taxpayers doing it. Hopefully, these charts help you see the future of what taxes possibly may be. There is also talk of a tax increase or proposal of a bond for new roads. It seems like it never stops.

If we took out the sinking fund and the ISD millage and replaced it with our bond, we actually as homeowners would save money, but yet our community wants us to pay even more with this new bond. Somewhere along the line sacrifices have to be made, and it shouldn’t always be the taxpayers doing it. Hopefully, these charts help you see the future of what taxes possibly may be. There is also talk of a tax increase or proposal of a bond for new roads. It seems like it never stops.